Credit Report vs Credit Score

Credit can be a fundamental tool towards helping to build wealth. I know you have heard the phrase “use other peoples money“. Well that’s exactly what credit is. Credit gives you the opportunity to use other peoples money in real time. Where many of us go wrong is that we fail to repay those funds in full in a timely manner.

I had to throw that last part in there because it is one thing to make a payment on your credit debt, but there is another thing to pay that debt off in full in a timely matter. If you ever wanna know and stay on top of what credit you have outstanding, you should get a copy of your credit report.

Everyone is entitled to a free credit report each year from each one of the three credit bureaus. Our credit bureaus are: Trans Union, Equifax, and Experian. According to the fair credit reporting act, you can contact these three credit bureaus for a copy of your annual credit report. Or you can simply click the link below to request a free copy. Go to www.annualcreditreport.com .

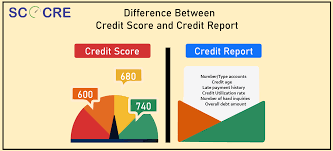

Now your credit report is going to report what is listed for your credit history and to whom. Your credit report will not give you your credit score.

You can obtain your credit score from various places. Remember there are two different types of credit scores. There is the FICO score and the Vantage score. You can get your Vantage score from free credit apps such as Credit Karma or Credit Sesame. However you will have to pay for your FICO score, which is the score that most lenders check for major financial purchases such as a house, a car, employment checks, etc.

Get started today with requesting your free credit repair report from www.annualcreditreport.com . You should know what message your financial position is telling other.

If you want to learn more about managing your credit, contact me for a 30 minute complimentary financial empowerment session. Click the link below to apply.